We offer a fixed fee for applications for Grant of Representation which is limited by the amount of assets in the estate. The price below details what is included and what limitations there are for the service. The grant of representation services include the completion and submission of the relevant forms and other required documentation for taxation as well as the completion and submission of forms for the grant of representation.

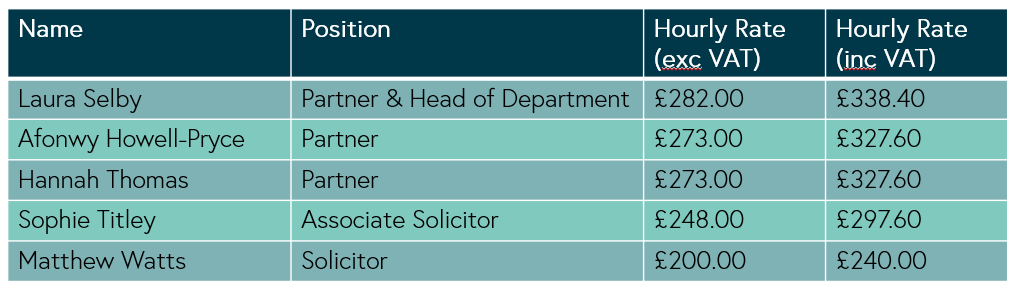

The below prices do not include VAT or disbursements